In 2005, the Peoria Civic Center broke ground on a $55 million expansion project. The project was completed on March 1, 2007. The project was approved in part because of a study done by Charles H. Johnson Consulting, Inc., in 2002 which predicted a positive economic impact for the expansion. Peoria would be able to attract more conventions, bringing more people to Peoria, which would lead to higher sales tax revenues.

I thought it might be helpful to look at the predictions and compare them to the newly-expanded Civic Center’s actual performance. Let’s look at these three indicators: Event Days, Attendance, and Net Operating Income.

First, to be fair, I should point out that the Johnson report’s predictions are for “a stabilized year of operation after facility improvements are completed.” What constitutes a “stabilized year of operation” is open to some debate. It could be as early as the third year of operation after completion, or as late as the fifth or sixth. We only have numbers up through FY2009, since FY2010 won’t be complete until the end of August. So, while it’s been three years since March 2007 by the calendar, we only have numbers up through August 2009, or roughly two years after completion of the project.

Nevertheless, it’s worth looking at the trends even this early for two reasons: (1) the time leading up to a “stabilized year” is called the “ramp up” time, and one would expect to see the numbers trending upward even if they haven’t yet reached the predicted levels, and (2) the success of the Civic Center is cited as one of the biggest reasons (if not the only one) for approving the Wonderful Development (i.e., downtown Marriott hotel deal).

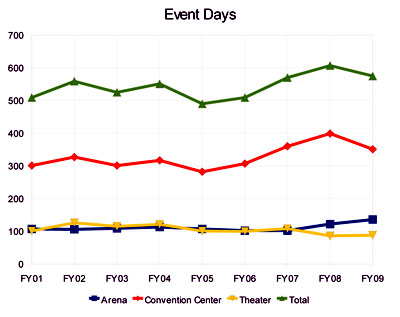

Event Days

The Johnson study predicted that the number of Event Days would rise from 510 (the total for FY2001) to 632 — a 24% increase — after expansion. Actual Event Days from 2001 to 2009 did trend upward to a peak of 607 in FY2008, but then dipped significantly in FY2009 to 575. Here’s the breakdown by facility (Theater, Arena, Convention Center), with the total shown in green:

When you look at the Event Days by facility, the Arena and Convention Center actually met or slightly exceeded predictions, whereas the Theater fell short in FY2008. However, increasing Event Days does not necessarily translate into higher attendance or more net income, as we shall next.

Attendance

The Johnson study predicted that Attendance would increase from 849,885 (FY2001 total) to 1,071,500 (26% increase) after expansion. Actual Attendance has indisputably trended downwards. Peak attendance was way back in 2002 when it reached 913,335. Since then, it has fallen every year except for 2008 when it bumped up slightly to 832,121.

It’s interesting that, even though Event Days trended upwards, attendance trended downwards. It’s attendance that we’re really after with the Civic Center, since it’s people who eat at restaurants, stay at hotels, and go shopping in Peoria, thus adding to our sales tax base. If attendance is going down, we’re losing money on the expansion. We would expect that to be reflected in the Civic Center’s Net Operating Income, and it is.

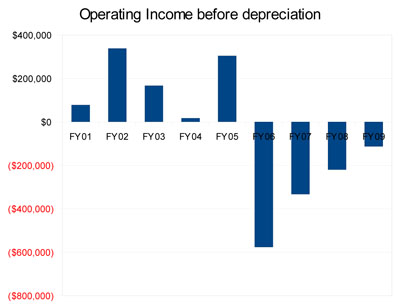

Net Operating Income

The Johnson study said the FY2001 Net Operating Income was $212,000. I’m not sure where they got that number. According to the Civic Center’s financial statements, there was a Net Operating Loss in FY2001 of $1,732,500. Even Operating Income Before Depreciation is only $78,333, although it’s at least on the positive side. I could find no reference to a $212,000 profit anywhere in the financial statement. It’s possible the amount was a preliminary figure that was revised subsequent to the report being published.

Nevertheless, Johnson predicted Net Operating Income of $1,519,000 after improvements. The actual picture of the Civic Center’s finances is not so rosy. From FY2001 to FY2009, the Civic Center suffered Net Operating Losses every year, and those losses are trending downward. FY2009 saw an all-time low loss of $4,273,556.

Much of this is a result of depreciation. If we look at Operating Income Before Depreciation, the trend from FY2006 to FY2009 is reversed, but still in the red.

At the current rate of increase, it will take somewhere in the neighborhood of fifteen years for Operating Income Before Depreciation to reach Johnson’s predicted levels.

Conclusion

While Event Days were close to reaching predictions before the downturn in business in FY2009, neither Attendance nor Net Operating Income show any signs of reaching their predicted levels.

Afterword

There’s one other prediction not related to the Johnson report that’s worth noting. That was the prediction in aMarch 24, 2006, memo from the Civic Center Authority to the Peoria City Council that stated:

The Peoria Civic Center Authority is not now and has not previously requested public funding for a hotel. We have always hoped that a private development would be interested by the Peoria Civic Center expansion and upgrade to come forward with a proposal. We hope that the community will enable such a development.The Peoria Civic Center Authority is committed and continues to be committed to the success of the expanded facilities. We believe it can be successful without an attached hotel but more and larger regional opportunities will be possible if more and better downtown hotel rooms are available.

Six months after that was written, the Civic Center Authority started pushing for an attached hotel. So now, after $55 million in investment that we were promised would be successful without a publicly-supported, attached hotel, taxpayers are being asked to back another $37 million in public investment for not one, but two headquarters hotels — a Pere Marquette Marriott and a Courtyard by Marriott. To bolster hotel supporters’ predictions that these hotels will be successful and realize 68%+ occupancy rates, another study has been completed, this time by HVS International.

All indications are that the Civic Center expansion is failing and the predictions by Johnson Consulting were, to put it charitably, optimistic. Yet we’re going to follow the same process of relying on rosy predictions from consultants and promises of success from the Civic Center (and Convention and Visitors Bureau) to give $37 million toward a headquarters hotel.

Why should we believe all these predictions of success? What empirical evidence is there that this project will pay off for the taxpayers? There is none.

No comments:

Post a Comment